This is the story of how I built Samera, my niche accounting firm over a 20-year period. The Ups and the Downs, the losses and the wins.

Many mistakes later, we are still growing and still developing, and I love what I do every day – however, there were times throughout the 20 years that I questioned why I was doing this and wanted to jack it all in.

But, it’s a HUGE BUT, we are still here, and I genuinely feel the next 20 years are going to be super exciting!

Before Samera

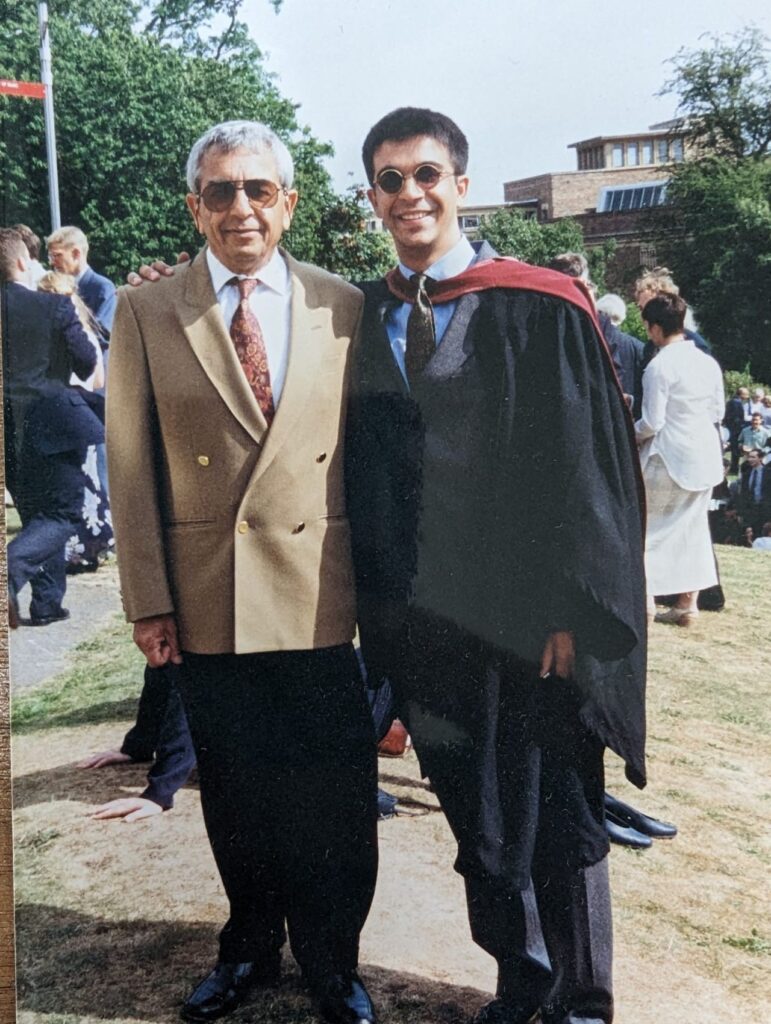

At University (Bristol) I gained a first-class honours degree in Engineering, but when it came to choosing a career, I really wasn’t that excited about what was on offer through the graduate programmes available for engineering. The pay was poor and the locations were not great.

So I decided I wanted to go into finance. That was where the money was at the time, with the buzz of the City the big attraction.

On the graduate recruitment rounds, I recall gaining interviews with various Investment banks and two of the Big 6 accountancy firms at the time (there were six in the 1990’s). Whilst banking looked very attractive with the higher salaries I felt gaining a qualification was the first step to become a dominant player in finance!

I joined Coopers & Lybrand in their fancy Embankment Places offices in 1995 (now part of PwC) and hence began my career in finance.

Now these were some great fun years, working with some very smart young people all in the same boat as me, seeking to excel in their careers in the London finance scene.

I qualified with PwC (the merger of Coopers and PriceWaterhouse occurred whilst I was working there), and worked for a year in Management Consulting with PwC.

But I found I still had an inkling to go and join an Investment Bank as that was where the big bucks were for a young 20-something.

I joined DLJ (Donaldson Lufkin and Jenrette) a New York-headquartered Investment Bank in their London office as a Telecoms Equity Analyst.

Not long after joining they were gobbled up by Credit Suisse First Boston (CSFB).

Eventually, I joined Bank of America, which was the last Investment Bank I worked for. My stint in banking was pretty short, but eye-opening in many ways.

I had a sick father, and was recently married, and felt that the role didn’t really allow me to be where I needed to be.

Whilst the money had been a great attraction, a big six-figure salary in the early 2000’s for a 20-something-year-old, I just felt I did not fit in. The culture, the very long hours, some of the people just weren’t my cup of tea – And never would be.

The idea of being an absent father, if I was lucky enough to have children, was one of the main drivers to step away from the City.

So, with the support of my wife, Smita, I decided to quit in February 2002. I ensured my bonus had been paid into my bank account and then quit my role by going to see my boss.

He was a very jolly chap, and he expected me to say I was joining another bank, but I told him I was quitting and going to do something of my own. He was surprised but understood my decision too.

I felt I had to do it at that stage of my life, when I was newly married, but before we had any children, else it would be difficult to leave a stable income!

At the time, I had no idea what I was going to do, but it wasn’t going to be working in Investment Banking.

I was put on gardening leave immediately, as the bank was concerned I may go and join a competitor.

After a few months of chilling and travelling with my new wife, then came the crunch, what am I going to do next?

I looked at various random business ideas, but I honestly knew very little about business, despite having an accountancy qualification. (Many accountants aren’t very good at business).

My father was nagging me to go and get a job again in the City, and I even had a few interviews, but I knew in my heart I wanted to run my own show.

So, with the pressure of my late father and a strong desire to not going back into the City, I felt the only thing I knew a bit about was accounting (how little did I know though!) so on the 16th October 2002, Samera Ltd was incorporated.

Samera was born

However, I was clueless, in my mid-20s and had no idea what type of clients I wanted.

I had worked in large corporates, and now I had set up an ICAEW registered Chartered Accountants firm with zero clients.

Living in Wimbledon at the time, I decided to attend a local Business Networking event to see if I could drum up any business.

And I did.

A local florist!

Nothing against florists, but I learnt pretty very quickly that they were not the right client for me, not much cash, disorganised and not really wanting my highbrow expertise J

So that business relationship didn’t last long!

Luckily for me, my wife, Smita became my inspiration for the Samera business.

The name Samera comes from our names!

S- Smita

A – Arun

Mera – Our surname without the “h”

Smita was and still is a dentist. I realised pretty soon that she knew her dentistry but had no idea about money, finance, tax or business (Sorry Smita, but she knows a lot now after setting up and selling many successful private dental clinics)

She then introduced me to her friends, who were very similar to her, and in that lightbulb moment, I realised I should focus on the dental market.

Again, small businesses, but an area I could get an initial foot in the door.

Whilst a great idea, focusing on such a niche was never going to be easy. I built my first website using MS Frontpage, attended various courses on marketing, spent a lot of money on advertising in Dental Press (that never worked) and struggled for almost one year to get any meaningful level of income.

Luckily, I had banked my banking bonus and kept it safe for a rainy day, as there were many of those in the first few years of starting Samera.

One of my real successes came from public speaking at various events for Dentists across the UK. I travelled the length of breadth of the UK speaking at regional groups about finance, and business.

Many attendees at such events didn’t take too kindly to an accountant speaking about how they should manage their businesses, after all, what does he know about dentistry?

But over time, these events became easier, and I started to build a bit of a reputation. Having a wife who was an avid supporter and of course, a dentist certainly helped.

My first accounting client ( I had done some consulting work in the year too) came from Essex, and I recall visiting this dentist and receiving a massive box of invoices and bank statements from the client, expecting me to know what to do with them.

I took them home, but honestly, I had no idea what to do with them.

Qualifying and working with PwC hadn’t really shown me how to prepare accounts from scratch. I only recall from my accounting classes the section on incomplete records, which I really did not enjoy.

So, the thought of preparing accounts from such records was my idea of hell.

But one thing I did know, and luckily, I had some funds in the bank, was that I needed to build a team.

So, with the box of papers received from the client sitting in my dad’s dining room, there was no chance I was going to prepare the accounts I needed to find someone to join my team who knew what they were doing!

Enter the Job Centre.

I placed an advert in the Job Centre for an accountant to join, and after a few interviews, I found a team member, Mahen, who went on to stay with me for over 10 years.

He was a qualified accountant from Sri Lanka and had just completed his MBA in the UK so was seeking a new opportunity. This was the beginning of a great friendship, and he now works for Nestle and lives just down the road from me!

Over the years, we built a local team, some of whom have moved on to other firms, or started their own businesses too. But at the same time, we started to outsource accountancy work to India.

Now this was in the days when there was no cloud accounting or OCR software! We had a permanent UK team member who would receive records from clients, scan them on our scanner, and then securely via FTP (file transfer protocol), send them over to India.

At the same time, we would have to send a QuickBooks backup file to India too, for the team to work on it there. Whilst it was a solution it was painful and often file transfers failed, after several hours, and would have to be done all over again!

The team in India was not our own team, but part of an Indian Chartered Accountants firm. I knew of them as they were distantly linked to my family, so had some reassurance.

They were one of the earlier firms providing offshoring and outsourcing services.

We used them for several years, but it wasn’t without problems. A lack of technical understanding, language issues, and time zone problems, were all there, but we persisted and trained a good team that supported us for some years.

But what became clear was that our Indian partner was eventually not able to retain many of our team members, perhaps because the pay was insufficient, or there were team-related issues. So, it felt like we were constantly training new team members, which was counterproductive.

In addition, we experienced a rocky number of years with our UK team. A new team had been built but just when you think things are settling, one of the key team members decided to leave, and steal clients (you know who you are if you are reading this, as I sure you are J).

So, the rebuilding process had to begin again, just before COVID.

I at best had a patchy Indian Offshore team, and the remnants of a small UK team, so just before COVID I made some tough decisions, I decided to close down the Indian operation and hire UK-only team members, and bring everything back to the UK.

That was the biggest mistake I made. Period.

COVID came, and whilst I had a few new UK team members they just weren’t up to scratch, with a revolving door of poor-quality UK accountants. Since I had no alternative, and could not find any suitable people in the UK, I had no choice but to go back and find an Indian team that could support and provide stability to my clients. At the time it felt like every second email I was receiving was either a complaint or a client saying they are moving to another firm!

However, I am not the type of person to take things lying down.

Throughout COVID, we documented and systemised most of the processes, but I felt despite the third-party India team doing a decent job, I could do it better if we had that team as part of our own organisation, and of course, save some £££’s.

After much deliberation, I decided to form my own Indian Offshoring team, which is employed by an Indian company which is a 100% subsidiary of my UK company.

Since then, we haven’t looked back.

Our offshore team has grown rapidly as we have secured further business, and we are on track for our best year since we began.

This is down to many people and strategies, but having a stable offshore has been one of the fundamental ingredients to our success, and in my view, offshoring is here to stay, despite many people claiming AI will take many of the roles.

With the benefit of silver-haired experience, and looking forward over the next 20 years, our focus at Samera is on the following key aspects.

The Next Few Years at Samera

Leading NOT Doing

I firmly believe that you cannot grow a firm properly if you are doing the actual client work.

In larger firms, managing partners rarely do client work as they are the “CEO’s” of the firm, dealing with growing the business.

The same principle applies to smaller firms.

The key is to build a firm that can run without you getting involved in client day-to-day work.

Easy?

No.

But possible.

I knew early on, that whilst I could do the technical work, it wasn’t really my area of interest, I was more interested in building systems and winning new business behind the scenes.

As I mentioned earlier, I certainly learnt the hard way when one team member who was a client liaison did poach some clients, I learnt from that, but still decided my time was better spent building rather than client handling.

Of course, I handle some of my early-day clients, but now I focus my efforts on nurturing and supporting the team with their skills so they can handle and become better accountants.

Building our Offshore Team

Our original plan with our offshore team was to have them bring stability to our back-office work. This has been achieved and is continually improving all the time.

When we started offshoring almost 20 years ago the technical knowledge was lacking and spoken English was challenging at times. However, today, the workforce in India is young and driven, many speak great English, and many even have UK or US accounting qualifications. The world of outsourcing and offshoring has changed in the last 20 years.

My back office is now actively involved in front office activities. Talking to clients, building relationships, and making friendships, something that didn’t happen 20 years back. Some of my India team will be visiting clients in 2025 to cement the relationships and enjoy coming to the UK.

For anyone not sure that an offshore team is the right thing for them, I can assure you, if you get the right people, it will transform your practice positively.

Combining an offshore team with the right technology is a game changer.

Leaders eat last.

“Leaders eat last” as Simon Sinek says.

And I truly believe this. Over the last 20 years there have been times I was worried about not having sufficient funds to pay staff, as some of the risks and strategies had not gone to plan. Even today, the question, “Can I meet payroll this month?” is always at the top of my mind – as I am not the only one relying on the business working, but my team and their families too.

I fully take ownership of the direction of the business and sometimes I have to make some tough decisions, but it’s not just for me, but more often for the wider team.

Like they are accountable to me, I am equally accountable to them for trying to make the best decisions.

A focus on the team culture

Culture is everything may well sound like a cliché, but in my experience, it’s the special ingredient that makes a business, and a super healthy environment for the team to thrive.

Find the right people, get them on the bus, and your job is to drive the bus AND keep the right ones on the bus until you reach your destination. That’s how you build the organisation you desire and the best environment for your team.

Now building and running a team in one country is hard, but doing this on a global scale with different cultures is something I love to do.

Is it hard? Yes, but totally fulfilling.

Helping each and every team member, young or old, become the best version of themselves is one of my drivers in running my firm. If I can help them achieve their aspirations, more than likely they will help me achieve mine in my firm.

Whilst much of our team is remotely based across Europe and India, we get the teams together as regularly as possible. Whether it is a Christmas gathering, a team “holiday” to Valencia, or a team bonding session in Goa, in today’s world of remote working, building a culture around a water cooler machine has changed, and organisations have to realise that people and their families desire the flexibility that technology has enabled.

Don’t underestimate the power of building a great culture and caring for your team. It’s essential if you are going to succeed!

Mastering Digital Marketing

From day one, I immersed myself in marketing Samera. Within 12 months, I realised marketing was probably the hardest part of running a firm, but also the most interesting.

As I mentioned previously, I built my first website using MS Frontpage, and then subsequent websites using WordPress. I attended courses across the globe, from Europe to the USA to try and understand what works, but more importantly what didn’t work.

Failure after failure, mistake after mistake, money down the drain, never to be seen again.

But all of this was a hugely valuable lesson to me, as I was experiencing that 9 things out of 10 didn’t work, but there was always one outlier that worked, and it would work hugely.

We exhibited at Dental shows, but the ROI was rubbish.

We did adverts in the Dental press, again a very poor ROI.

But all roads lead back to the website. My initial website was pretty basic but I always enjoyed writing and sharing my experiences, and would do much of this on the website, along with developing a newsletter list.

Over time this list grew in numbers, and now we have thousands of readers of our emails each week in our niche market. This has greatly helped us grow and become a leader in our field.

Along with writing content we also experimented with videos on YouTube, and whilst we may not have many subscribers, we gain clients from old videos we did several years ago. Even this week, someone said to me they saw an old video of mine and liked what I was saying and so reached out.

Today, my marketing team is much more than me. However, I had to do much of it myself to learn what works and then define the strategy.

My marketing consists of a full-time front-end developer based in the UK and an SEO expert in the UK too. In India, I have two content writers, a graphic designer, a video editor and a social media person.

I may be the face of much of the marketing, but it’s my super global team that helps me achieve our presence.

Going forward we will be double downing on our content production hopefully adding value to our client base with useful and trustworthy content.

I see this as one of the keys to the future growth of Samera and would strongly recommend that if they want to build a strong brand in a particular sector is to focus on creating great content.

Don’t be a tech luddite

We all know AI is here, and will transform how accounting firms are run. But as with all technologies, the key is to embrace it and use it in the most effective manner possible.

Don’t be scared of it, technology with the right people (onshore or offshore) will help you grow your firm.

The key is to train your team in how to use it, and let them master it – remember you lead, and they will follow.

Diversifying your Income Stream Through Cross-Selling

Perhaps one of my biggest weaknesses is I get bored too easily, I certainly love to try new things out.

But in business, experimentation is often very helpful. Over the years we have added quite a few services to our niche of dental clients.

We started with all the usual compliance services of Bookkeeping, Accounts Production, Tax Compliance and Payroll, but over the years we have added:

- An FCA regulated Commercial Finance Brokerage, assisting clients raise finance for acquisitions or new start up businesses

- A Dental Brokerage – where we help clients buy and sell their dental practices

- A Buying Group – where we have negotiated great terms with certain suppliers so members of the buying group gain better terms

- Digital Marketing Support – where we offer a whole host of services from website design to SEO.

- Outsourced Finance Department – where we offer a full finance department for clients businesses.

Our objective has always been to support our clients on their financial journey, so offering a range of complimentary services has been a great growth area for our firm. We intend to build on this in the coming years.

Of course we have also done advisory work too, but we have often found it not scalable and very dependent on key team members, often me.

Whilst the income can be great, I find the opportunity cost of me focusing on actually growing the business and leading the firm is lost if I have to provide ongoing business advice through business advisory services.

I do enjoy providing advice, but when it ties you down, that limits my growth, as after all that’s one of my key objectives of why I started my firm in the first place.

To do what I want, when I want, with whom I want!

Have I achieved that?

Yes and No.

Yes, I could certainly stop and let the business run, but I love it just too much, and really love my team as after over 20 years in this game, I feel I am only just beginning and know what to do now, after the many mistakes I have made in the last 20!

About the Author

Arun Mehra

With almost twenty years of commercial experience and knowledge in Dentistry, Arun’s expertise is valued by hundreds of businesses across the UK. His financial acumen and know-how, along with his hands-on commercial expertise have helped clients, large and small, new and established to achieve great things.

Arun is the founder of the Samera Group, starting the business with just one client sitting at his father’s dining table. Fifteen years on, Team Samera now service hundreds of Dental clients, run exciting events, help clients raise finance, and are very active in helping clients buy or sell Dental practices.